Total Employment Costs for Qualified Staff

Latest Update: December 6, 2021

A key factor for companies looking to set up sales or sourcing operations is employing able personnel to represent them in Vietnam. Of course, a major question is how much cash should be set aside to remunerate this staff. It seems important to understand that gross salary tends to be only a minor part of the total employment costs. This article will try to establish a simplified exemplary calculation presenting a rough price tag at the end of the process. The following text refers to qualified staff employed with tasks i.e. in management, sales, sourcing, engineering or programming. For manual labor working on shop floors a different set rules and recommendations applies.

*Please note that all following calculations are applicable for Vietnamese employees.

Salary

Naturally, salary will be the biggest part of the costs of an employee. Employers typically negotiate gross salaries with candidates. Further information on salaries can be found here in the FAQs on Employing Staff in Vietnam.

For our calculation we utilize an amount that could be applicable for many qualified sales or engineering personnel.

👉💸 Annual gross salary: EUR 18,000 (monthly: EUR 1,500)

Bonus

Paying a yearly bonus is technically voluntary but culturally mandatory in Vietnam. On average, it adds about 10 to 20% to the employee’s annual salary. The bonus will be paid before the “Tet” Lunar New Year Festival which is – depending on the lunar calendar – mostly being celebrated in January or February. It may be fixed to certain performance indicators, such as sales volume. The employer should however be aware that staff will show response if the bonus is deemed too low. Just imagine employees traveling home to their families for the Tet holidays: There, the past year will be discussed; also in professional and financial terms. If employees do not have an adequate bonus (or wage raises or promotions) to show for they might be prompted to rethink their career choices… and to switch employers. It is therefore advisable to give employees something to present at home.

👉💸 Gross bonus: EUR 2,700 (15% of salary)

Employer SHUI and Trade Union

In Germany, employee and employer mostly contribute equally to social insurance. The Vietnamese system is however much more “employee-friendly”. The employer has to pay a whopping 21.5% (2x of the employee contribution) on top of the employee’s gross salary for SHUI (standing for Social-Health-Unemployment-Insurance). An additional 2% has to be contributed to the labor union.*

👉💸 Annual employer SHUI/labor union: EUR 3,384

Thus, if an employer negotiates an annual gross salary/bonus of EUR 18,000 with her staff, she has to add roughly 34% for bonus and employer SHUI/union to calculate the total payroll.

*Because the base for SHUI/union due assessment is capped at ca. EUR 24,000 p.a. in the above-mentioned case the actual amount to pay would be roughly 16% of the gross salary.

Extra Benefits

To maximize retention rates and motivation many employers resort to granting extra benefits to their staff. The following EUR amounts are calculated on an annualized basis.

Incentive Trips

Information on this employer branding benefit can be found here. Provided that the employee uses Economy Class and does not stay more than a couple of days the following budget should be sufficient.

👉💸 Price tag: EUR 2,000

Travel Allowance

Most jobs demand some form of travel. In the big Vietnamese cities, it is recommended using taxi cards or the ride hailing service “Grab” (which can issue VAT invoices). Longer distances to neighboring provinces will mostly be traveled by car. For the occasional trip, booking a driver and a private car is advisable. These options are neat and tidy to settle because the employer will receive proper invoices for them. For more frequent travel, the employee may ask for a travel allowance in order to steer her own car or motorbike to destinations. For the employer, this may be cheaper than procuring driving services. However, allowances are hard to fix as employees sometimes travel more, sometimes less within a month. They also might be misappropriated ending in non-compliance. Further, travel allowances are subject to SHUI and PIT. For our sample calculation we fix these at the following annual amount including employee SHUI/PIT for a car.

👉💸 Price tag: EUR 1,800

Team Building and Year-end-Parties

Information on team building and year-end parties as employer branding incentives can be found here.

These events may come costly for the employer with a price tag as high as...

👉💸 Price tag: EUR 1,000

Training

Information on training can be found here. Following costs may be reserved annually.

👉💸 Price tag: EUR 1,000

Cell Phone

For employees often working outside of the office or with a lot of contact to external partners (such as customers or suppliers) the provision of a company cell phone is advisable. Firstly, such staff simply expects this from the employer. Secondly, it is rather widespread for Vietnamese employees to use private phones for business communication. The employers should therefore prevent staff from excessive use of (uncontrollable) private technical equipment for business purposes by supplying company phones. As phones are considered important status symbols their use will convey a certain message to external partners. Therefore, upscale models should be procured. Under the premise that the employer will provide a new phone for EUR 1,000 every other year and a standard phone plan the following price tag may be applied.

👉💸 Price tag: EUR 1,360

Supplementary Health Insurance

More information on supplementary HI here.

👉💸 Price tag: EUR 480

Health Check-Up (Mandatory)

Employers must offer a yearly health check-up to their staff. This benefit is surprisingly popular in Vietnam. Most employees will (happily) take advantage of it.

👉💸 Price tag: EUR 200

Summary

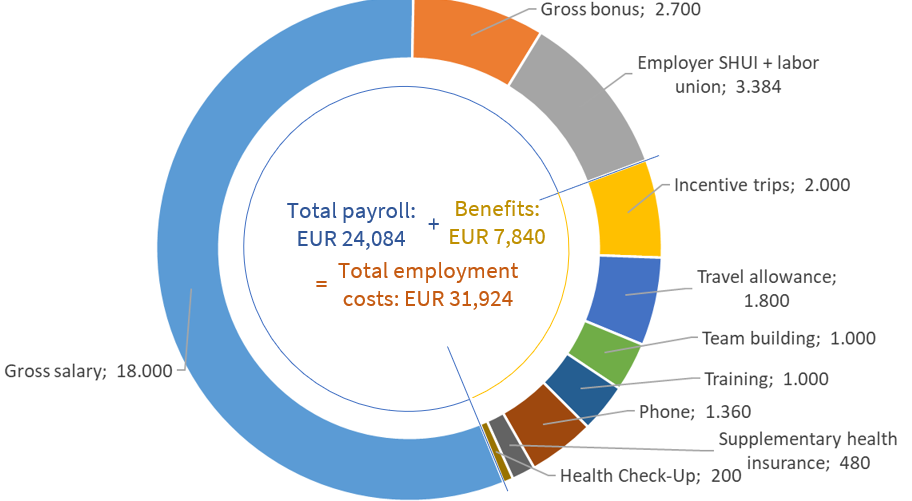

Hopefully, this article has made clear that salary negotiations in Vietnam do not end with fixing the gross salary and that total payroll should not be the basis to calculate the total employment costs of an employee to her employer. The calculation should be:

Gross salary + bonus + employer SHUI/union = total payroll

Total payroll + benefits = total employment costs

In fact, gross salary can make up as little as 56% of the total employment costs.

Overview: Exemplary make-up of total employment costs

A simplified calculation for total employment costs can be downloaded here:

Of course, the above-mentioned benefits include all sorts of options available. Some of our customers are indeed offering the whole set of them. However – usually – employers will not resort to utilizing all. The most common benefits include the health check-up (mandated by law), supplementary health insurance and team building. Other options might be reserved to key personnel.

Furthermore, some benefits are only feasible in certain company constellations. For instance, in an office with only two or three persons a company trip will probably be replaced by a nice dinner and Karaoke. Also, for staff that only works in the office or from home travel allowances might be redundant.

Finally, the benefits and prices noted here are clearly positioned in the upper echelon of possibilities. There are cheaper options available in Vietnam. However, to show appreciation or gratitude and to improve the company’s status the employer should not shy away from spending. Adding 10 to 20% of benefits to payroll costs may be advisable for qualified staff. For key personnel, this figure can be as high as 35% to arrive at total employment costs.

Again, as noted above, it should be noted that the above numbers and calculations are simplified and generalized. For questions you may turn to us and/or to payroll/staffing companies. Please consider this information without liability for any data with respect to content, completeness or up-to-datedness. For legally valid information you should turn to a lawyer.

Related resources:

-

Navigos Group - Annual report on benefit trends accessible here

-

GTAI - Overview Payroll in Vietnam (German only) accessible here

-

Attracting and Keeping Staff accessible here